Metal Injection Moulding in Japan: Applications and materials insight from the 2022 JPMA MIM Market Report

The Japan Powder Metallurgy Association’s (JPMA) annual statistics report on Metal Injection Moulding provides unique insight into the ongoing evolution of the country’s MIM industry. As well as revealing a continued upsurge in production in 2022, changes in the applications and materials mix offer visibility into growth areas for the industry. We present the published data along with insight from the JPMA into wider factors that influenced the broader Japanese PM industry in 2022. [First published in PIM International Vol. 17 No. 3, Autumn 2023 | 10 minute read | View on Issuu | Download PDF]

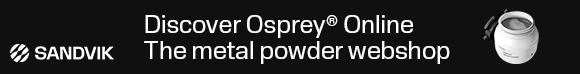

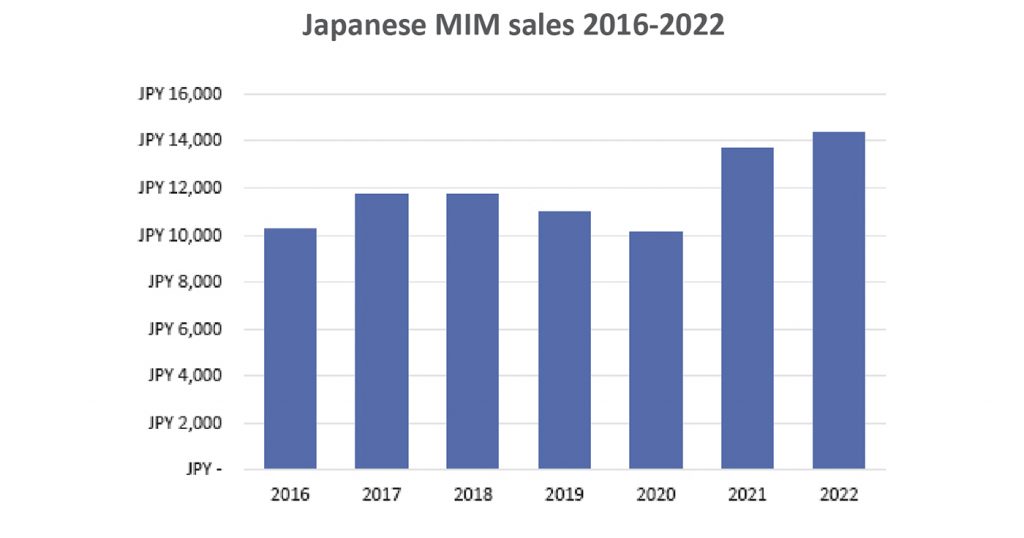

It has been another positive year for Japan’s MIM industry, in contrast to the declining volumes for structural PM parts. In his introduction to the Japan Powder Metallurgy Association’s 2022 Annual Report, its Executive Director, Yoshio Uetsuki, shared insight into another challenging year for Japan’s wider Powder Metallurgy industry and the factors that influenced the industry. Whilst 2022’s MIM sales increased over the previous year (Fig. 1), the industry was inevitably influenced by wider political, social and economic developments. Uetsuki stated, “2022 was a turbulent year. An optimistic outlook of recovery from the COVID-19 crisis at the beginning of the year has turned out to be an unexpected development due to soaring international commodity prices such as food and energy, accelerating inflation and economic deterioration in Europe and the United States.”

He explained that the domestic economy was affected by the decrease in automobile production and high resource costs. “The global economy has followed a recovery trend since the COVID-19 crisis, but the pace of economic recovery has slowed due to high inflation and monetary tightening. On the other hand, in Japan, economic activity was stagnant due to the decrease in automobile production with a shortage of semiconductors and high resource prices, but in the latter half of the period was supported by personal consumption and capital investment.”

Under such an economic environment, the domestic production volume of vehicles (including buses and trucks), decreased by 0.1% from the previous year to 7.83 million units, according to Japan Automobile Manufacturers Association statistics. However, compared to 2019, it is 19.1% lower, far behind pre-COVID-19 levels.

Uetsuki also emphasised an accelerating shift to carbon neutrality. “While countries around the world are taking steps to accomplish ‘2050 Carbon Neutral’, the Japanese Powder Metallurgy industry is also required to accelerate the necessary actions to go with this trend.”

It was also stated that repeated production adjustments for PM parts had to be made due to a number of complex factors, including COVID-19 policies in other countries, Russia’s invasion of Ukrainian, and the unstable supply of ‘old-generation’ semiconductor chips. “As a result, production was either cancelled or orders for [PM] machine parts decreased, leading to a decrease in machine parts production volume for vehicles. It is predicted that the shortage of semiconductor chips will continue to impact machine parts production until the second half of 2023, with a full recovery expected only after 2024.”

Japan’s MIM industry: overall market growth

The JPMA collects some of the most accurate and insightful market data in the industry, based on a detailed questionnaire that was, for 2022, sent to nineteen companies, including member and non-member MIM part producing companies. Data was returned by all nineteen companies.

Total sales of MIM parts by Japanese producers in 2022 was reported as ¥14.35 billion, a 4.8% increase from the previous year. This was led by the increasing demand for industrial machine parts and medical device parts, a trend which continued from 2021. Fig. 1 shows Japanese MIM parts production by sales value, from 2016 to 2022.

In 2023, the JPMA predicts that the demand for semiconductor manufacturing equipment parts will slow. However, it is forecast that overall MIM sales will increase to more than ¥15 billion as a result of demand from other markets.

Breakdown of MIM applications

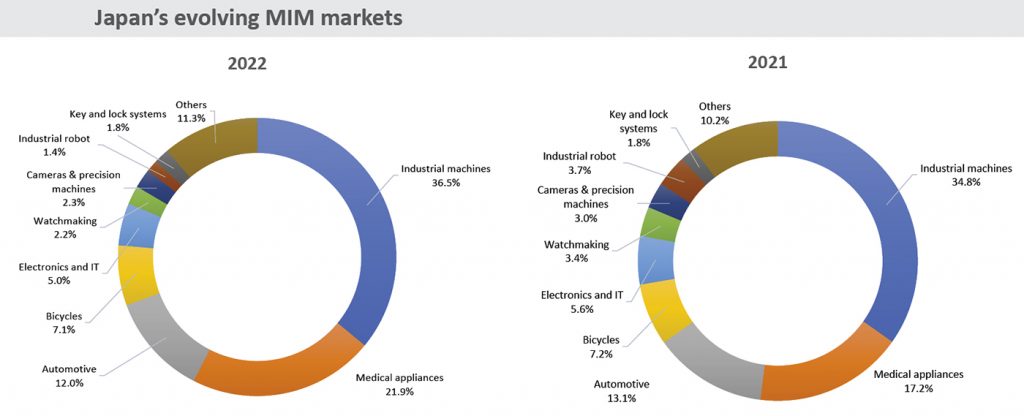

Fig. 2 shows a breakdown of MIM markets for Japan’s MIM producers in 2022, with 2021 data for comparison. The general industrial machinery sector accounted for 36.5% (previous year: 34.8%), medical devices accounted for 21.9% (previous year: 17.2%) and automotive accounted for 12.0% (previous year: 13.1%). The combined total of industrial machinery, medical devices and automotive was 70.4% (previous year: 65.1%).

The industrial robot sector, which saw growth in 2021, decreased in 2022 year as a resulted of reduced capital investment by industry. However, despite this setback it is seen by MIM producers as a sector with remarkable market opportunities.

With regards to semiconductor manufacturing equipment parts, this sector also offers high growth potential, driven by strong market demand for IoT, vehicles, data centres, and AI applications. Although slowdown of the demand for these applications in 2023 is predicted, further growth in demand can be expected after 2024.

Breakdown of MIM materials

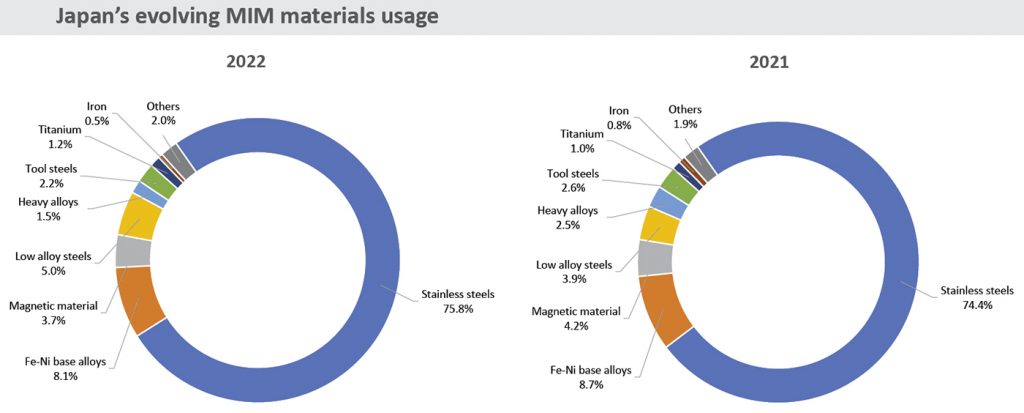

Fig. 3 shows a breakdown of MIM material usage by Japan’s MIM producers in 2022 and 2021. Stainless steels accounted for 75.8% of production (previous year: 74.4%). The combined total of stainless steels, Fe-Ni base alloys, low alloy steel and magnetic material accounted for over 90% of the market.

The sales value of stainless steels, by far the the most important material for MIM, was given as ¥10,872 million, a 6.6% increase from previous year. Low alloy steel products, which, stated the JPMA, offer a superior balance between quality and cost, have been in strong demands for industrial machinery parts and automotive applications. Consequently, their sales value grew from the previous year. The sales value of MIM titanium parts remained low, but with a 28.6% increase from the previous year.

Promoting MIM in Japan: The JPMA’s first MIM course

In 2022, the JPMA and its Injection Molding Powder Metallurgy Committee hosted their first Metal Injection Moulding Workshop on March 4, 2022. The course’s participants gained basic process knowledge and were presented with ‘Kaizen’ case studies. The one-day workshop succeeded in raising awareness of MIM technology as well as covering raw materials and equipment.

World PM2024 Yokohama: A meeting place for the global MIM industry

Twelve years after the successful PM 2012 World Congress in Yokohama, the JPMA, together with the Japan Society of Powder and Powder Metallurgy (JSPM), are organsing the 2024 World Powder Metallurgy World Congress & Exhibition, set to take place in Yokohama once again on October 13-17. MIM – together with sinter-based metal Additive Manufacturing processes – promise to be high on the agenda. The Call for Papers invites presentations on the following topics:

PM Technology

- Powder Production: Powder modification, atomisation fundamentals, atomisation process development, innovative processes, powder characterisation, etc.

- Processing: Compaction and sintering, modelling and sintering, Hot Isostatic Pressing, field-assisted sintering technologies, AM beam-based technologies, AM sinter-based technologies, machining for AM, MIM process and other forms of processing

- Industrial Applications: Biomedical, aerospace, automotive, energy and other PM applications

PM Materials

- Sintered Materials: Ferrous materials, non-ferrous materials, light materials and high-temperature materials

- Hard Materials: Cemented carbides, cermets and ceramics, hard coating, diamond and cBN

- Functional Materials: Magnetic materials, photo-functional materials, dielectric materials, composite/hybrid materials, functionally graded materials, and other functional materials

- Other PM Materials: High Entropy Alloys, metallic glass, material characterisation, and others

Topics for a Better World

- Carbon Neutral (CN) in PM (eco processes and materials)

- Circular Economy (reuse, recycle, remanufacturing)

- DX in PM (material informatics and integration)

Submitted papers will be reviewed and allocated to oral or poster sessions by the Technical Committee by the end of February 2024, when acceptance notifications will then be emailed to the authors.

Abstract submissions open on October 16, 2023, and close on January 15, 2024. Abstracts are to be submitted online and in English.

Further information

www.jpma.gr.jp

www.worldpm2024.com