CMG Technologies: The UK’s only MIM producer on its acquisition by Indo-MIM and expansion into filament-based AM

CMG Technologies Ltd, the UK’s only producer of components by Metal Injection Moulding (MIM), has had a busy few years. Most recently, the company hit the headlines when it was acquired by Indo-MIM, widely considered to be the world’s largest MIM producer with significant operations in India and the US. Prior to this, CMG had been expanding its presence in the metal Additive Manufacturing arena, developing its own range of filaments and providing toll debinding and sintering services to users of BASF’s Ultrafuse products. Dr Martin McMahon visited the company and reports on developments. [First published in PIM International Vol. 17 No. 4, Winter 2023 | 20 minute read | View on Issuu | Download PDF]

Perhaps one of the UK manufacturing sector’s best kept secrets is the success of a small Suffolk-based firm with the unrivalled position as the only UK-based Metal Injection Moulding (MIM) company, whose expertise further extends to feedstock production and sinter-based Additive Manufacturing. The intrigue of this alone was reason enough to warrant a visit, but recent events at the company pushed me to make the journey across the East Anglian countryside.

Readers familiar with the British landscape may be surprised by this; the region is often misunderstood, with most seeing this part of the country as being dominated by agriculture. Certainly, the journey through narrow wooded lanes, bordered by seemingly endless green fields, appeared to confirm this impression.

However, this region also holds a legacy from World War II and the Cold War, with various disused airfields spanning the landscapes. Several of these sites are now home to a growing number of manufacturers, start-ups and even some well-established firms. It was one of those locations that hosted my meeting with Rachel Garrett, Managing Director of CMG Technologies Ltd. I joined Rachel to learn about the company’s journey to the forefront of the MIM sector in the UK, and understand more about the acquisition made by Indo-MIM in July – one of the world’s largest MIM companies, as well as a metal powder producer, with operations in India and the US.

The history of CMG

CMG Technologies Ltd has been providing injection moulded components to the medical and opto-electronics sectors for over twenty-five years. The beginnings go back to the mid-1970s when Europlus was formed as a dedicated precision machining company. It later expanded into plastic injection moulding and built up a very successful business supplying the the emerging fibre optic telecommunications sector. It was as a result of this growth that Chris Conway was recruited into the business from Hewlitt Packard, taking on the role of Managing Director.

When MIM was first introduced, Conway brought in Phil Marsh, from Manganese Bronze, and Martin Scripps for their expertise in Powder Metallurgy and the new MIM process. Between them, the three men grew a very successful business until – through their perseverance and dedication to MIM technology – the company was acquired by one of its leading customers, France’s Egide, in 2002.

This came right at the end of the dark days following the telecoms ‘boom and bust’ period that started in the spring of 2000. This forward-thinking team then continued to run the business for more than a decade, the end of which saw the retirement of Scripps from the company. In 2013, Egide decided to move away from precision component manufacturing, leading Chris, Phil, and now Rachel Garrett, who had moved up to the management team, to complete a Management Buyout (MBO) to form Conway Marsh Garrett Technologies, and the company now known as CMG Technologies was established.

Today, the company is being steered by Garrett, who could never have imagined taking the reins when she first joined the business in 2004, when the company was still owned by Egide and run by her late father Chris Conway. She works alongside the other director of the business, Phil Marsh, who joined the company in 2000.

Current operations

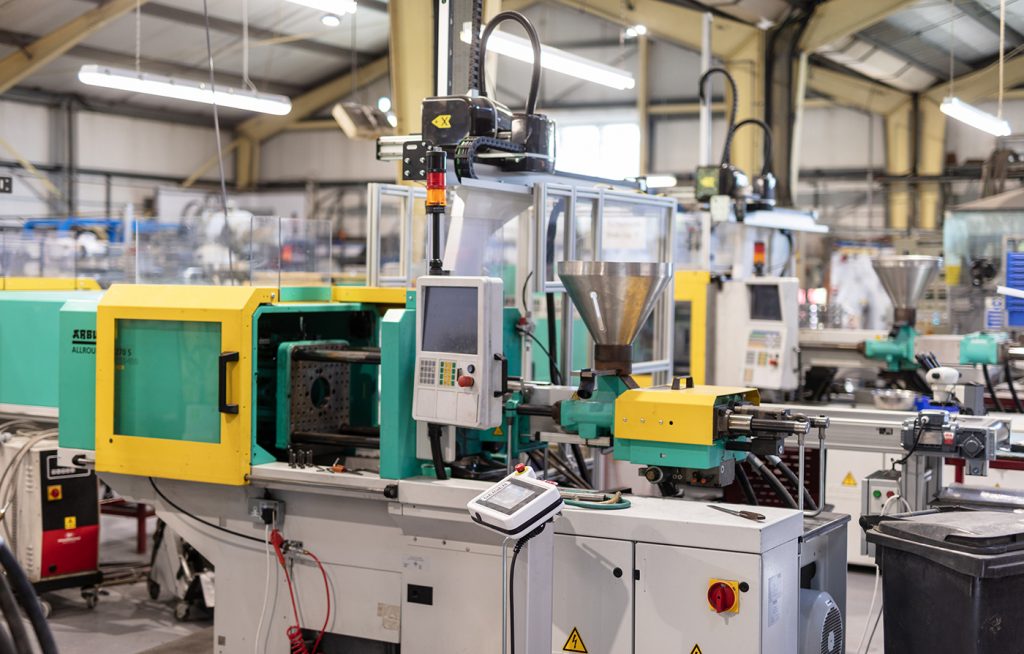

During my visit, I found a company that was small enough to still be called a family business, a fact underlined by many aspects of the operation. And yet it remains innovative and modern in its approach to dealing with the everchanging world. From its modest beginnings with just one injection moulding machine and practically one customer, the company now operates eight injection moulding machines, a robotic system for the automatic removal of moulded parts, six debinding furnaces, and four sintering furnaces, including vacuum furnaces. To this, CMG has also added three in-house feedstock mixing machines and a small selection of filament-based Material Extrusion (MEX) machines – a process also referred to as Fused Filament Fabrication (FFF).

It is often difficult for small companies deeply rooted in the local environment to find new ways of working, but CMG Technologies has avoided this trap because another innate aspect of its culture is that of innovation. With a mix of parts that uses either commercially available feedstock from the likes of BASF, or its own in-house developed and mixed feedstock, CMG has the flexibility to select the best solution for any given application.

CMG Technology’s management team is always seeking to make improvements and, rare amongst those in manufacturing, not afraid to introduce change. In relation to its feedstock expertise, the company’s output now also includes metallic filaments for use in a range of filament-based AM machines, which coincided with the introduction of Additive Manufacturing as a service in 2021. “Having that know-how on making MIM feedstock meant it was only a small incremental step that was quite logical for us,” explains Garrett. As she went on to describe the process to formulate the compounds necessary to make the filaments, it was easy to see how the company is also able to utilise the debinding and sintering expertise that it has developed in-house.

Over the years, the company has had many order enquiries which don’t always fit with its standard 316L and 17-4 PH stainless steel feedstocks. This led the team to develop tailored solutions, an area in which the expertise of co-founder, Phil Marsh, has been paramount. Being able to provide MIM solutions through the development of feedstocks to produce parts in advanced engineering alloys (e.g. Inconel, Hastelloy, and Kovar) has positioned CMG at the forefront of this niche in the market. I was told about one customer that had started to experience issues in the field with some components that were not strong enough. The CMG team was able to transition this part from steel to one of the Ni-based superalloys, without any significant cost increase to the customer.

CMG has not only taken a lead in terms of the technology and materials, but also in its approach to everyday work. Take, for instance, its introduction of a four-day working week in 2015, several years ahead of the UK’s mainstream trial last year. This has allowed all employees more time with their families and to pursue other activities, whilst the company still runs a double shift pattern with continuous production, seven days a week. That’s almost unheard of anywhere else in the British manufacturing sector, and Garrett attributes much of the company’s current successes to this way of working.

Family is obviously a very important part of the business culture; taking over the role in 2018 after her father passed away, Garrett works part-time as Managing Director of the business in order to spend time with her own family. She’s also joined in the company by her partner, who is responsible for maintenance engineering. Garrett stated that many others in the company also work with partners and family members.

The UK MIM market

Talking about the status quo of MIM in the UK, Garrett commented on the pros and cons for the small company: “We’re the only ones in the UK doing the complete MIM process from scratch, which is nice because if someone wants a UK-based company, then that’s a positive for CMG.” However, she then went on to say, “There’s also a downside, because we’re the only company in the country talking about MIM and trying to promote the process.” This can be a very difficult situation for any business trying to introduce an alternative solution into any sector, and often success largely depends on the passion of an individual. Here, Garrett talked about her father’s passion for the MIM process, and his determination to see it succeed for their business when others had turned away, failed, or simply chose to outsource to Asia.

The more common model in the UK is that of companies offering MIM sales but with all production carried out overseas, mainly in Asia. However, being the sole MIM producer is not always a hindrance, and indeed the company’s growth and current position has partly come about because of customers that have come to them as a result of cessation or poor service by an overseas producer.

Given the above, one would have imagined that the UK domestic market alone would saturate demand for CMG’s services. However, as a result of the steady growth that has come about by responding to the right opportunities, the company now gets 25% of its business from overseas. These exports are primarily to mainland Europe, but also include a small fraction to the US. This is impressive considering that CMG has never had a dedicated salesperson, with all business being won either through historical relationships, or by the management team themselves hitting the road. This is about to change though, as the new owners plan for growth through the addition of a Technical Sales Manager to the team.

Customers

Serving a selection of customers in light industries, with some business coming from the consumer market and some from automotive, CMG’s main business currently comes from the medical sector, and it is very likely that this will remain a key area for the company under the new ownership. As a vital producer for companies that are supplying into the UK’s National Health Service (NHS), and with the current backlog of operations that increased significantly due to effects of the COVID-19 pandemic, CMG has a pipeline of business for a good few years into the future.

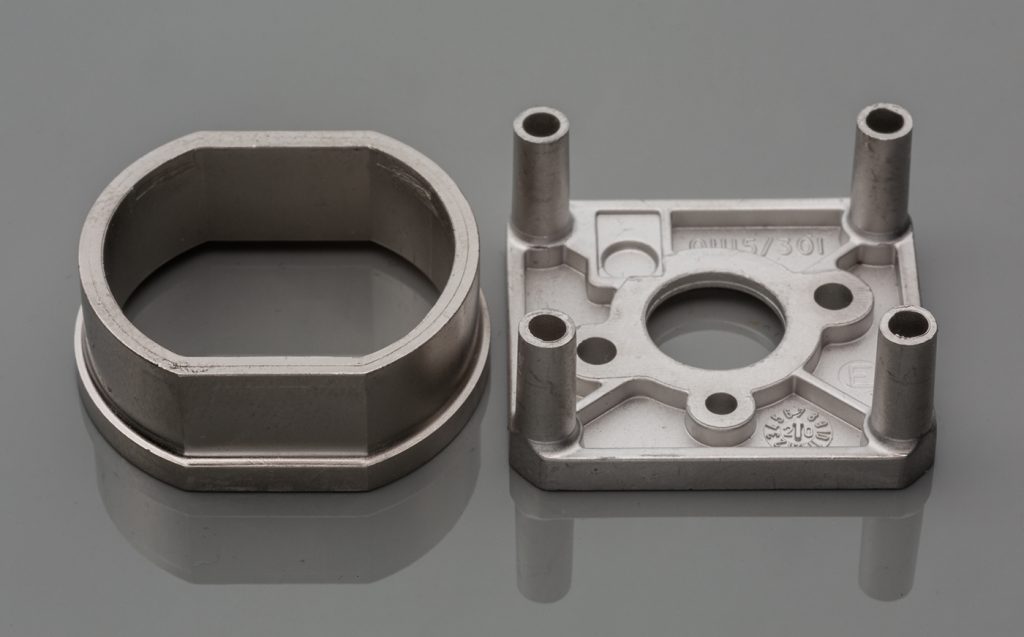

This is particularly aided by the fact that many of the MIM parts produced are for items classed as single-use under current NICE (the UK’s National Institute for Health and Care Excellence) guidance. Take, for example, the many types of jaws used at the end of surgical manipulators and lances for keyhole surgery and biopsies – it’s considered too time-consuming and expensive to clean and sterilise these parts, so they are simply replaced after each use. “We found that MIM really came into it own around these types of projects, where you still needed the complexity, but you also wanted it at low cost,” Garrett shared.

The medical sector was also the reason CMG was able to stay fully operational during the COVID-19 pandemic and its related lockdowns. Other areas of the business may have slowed down in this period but, due to one customer that required critical parts for its ventilators, CMG was actually able to increase production. Speaking about two such components, Garrett commented, “We would normally make about 1,000 a month, but, during COVID, in one month we made 20,000 of each type of part; it was a really crazy time for us and we actually employed a couple of additional people.”

So, there you have it: a little known, but uniquely successful, business tucked away close to the coast of Suffolk, managing to hold its own in a world dominated by international players. A company growing at a slow and steady pace and very comfortable in what it has been achieving and is able to deliver. This is precisely where Indo-MIM comes into the story. Not looking to be acquired and happy with their lot, Rachel Garrett and Phil Marsh, the two remaining shareholders of CMG, were quietly approached in the latter part of last year. That’s when CMG’s journey started to take a new direction.

Interest from Indo-MIM

Following some rapid negotiations during frequent meetings between CMG and Indo-MIM, the deal was concluded in just a matter of months. It was during the latter part of the summer that we heard of the takeover by Indo-MIM; a surprise move I’m sure no one from inside the sector would have seen coming. Why would Indo-MIM, an international leader in the field of MIM with annual turnovers of between £120-170 million, want to acquire this small UK-based firm with its modest turnover of £3-4 million?

The answer to this question tells a story of aspirations and of recognition of the value of a business that has grown from humble beginnings through the hard work of a dedicated management team.

When Indo-MIM initiated its search for a business to buy in Europe or the UK, it wanted a MIM business that had stability, a mindset for growth, a management team which would stay on through the transition. As luck would have it, CMG met its criteria perfectly, and both Rachel Garrett and Phil Marsh will continue to lead the company into the future, only now with the support of a robust overseas supply chain that encompasses all key aspects of the MIM process, from powders to an even wider global customer base.

Let’s be clear: CMG wasn’t a company looking for a buyer and it was enjoying steady growth, with particularly loyal customers in the medical sector and fibre optics sector. This can partially explain the motivation of Indo-MIM for the acquisition, since it serves it well to own an operation that could continue to stand alone and operate without intervention. At the same time, this gives Indo-MIM a firm foothold in the UK and serves as an ideal launchpad into the rest of Europe, which is already strongly supported by a sales office in Germany.

CMG welcomed this takeover as it had always recognised Indo-MIM’s success within the Metal Injection Moulding supply chain. The company management team knew that this would be an ideal way to help it grow far faster than it could manage by itself.

As stated, this acquisition took place very quickly. With visits to India to see the scale of the operations in and around the city of Bangalore, and respective visits to Suffolk, there was an almost instant realisation that it was a good fit for both parties. One, a global family-led business with a strong tradition of bringing its employees along on its journey, and the other, a small company that has become a family of sorts in itself, with management and team members that have been there for decades. Looking at it from the outside, it’s not difficult to interpret the arrangement as more of an adoption than a traditional acquisition.

The future under Indo-MIM

“The integration between our companies is still at an early stage, so the directions aren’t completely set. But keeping our culture alive and maintaining existing customer relationships is a key priority for Indo-MIM,” Garrett shared. But does this signify the start of greater expansion by Indo-MIM into the UK and across Europe?

That remains to be seen, but this acquisition has created a unique synergy allowing Indo-MIM to concentrate on MIM projects that are really high volume, and where the part costs are very low. CMG, on the other hand, targets comparatively low-volume products and concentrates on maintaining a good margin. Where previously each company would have had to turn down projects due to either too high a cost for low volume or a lack of capacity for high-volume work, respectively, they can now offer that service to their customers.

Both companies have identified areas where they can now return to previous opportunities to add orders for their businesses. This will no doubt also enable them to seize more business globally, which sits well with the plans for growth at the site in Rendlesham.

Garrett explained that the current site will be CMG’s initial point of growth and it seems that investment into that site will enable further development of its automated lines, with planned installations for additional robotic systems in the coming years, as well as greater sintering capacity when the company adds another furnace to the facility in the coming months. Garrett added, “We have automation on the moulding line, but now we’ll be looking at automation on the staging part of the process as well, and, whilst there’s investments being made in automation, this will create opportunities for our current employees to extend their skill set as well and learn different parts of the process in the automation side of things.”

More sintering capacity and more automation will optimise what is already in place. One niche which would suit more automation is when parts coming out of a furnace need a secondary operation, like a coining step; any such additions to CMG’s lines will only improve its throughput. It doesn’t just stop at the factory floor hardware either, and Garrett explained that the company is eager to modernise operations with the introduction of specific MES software. Like many similar small operations that have grown organically, software wasn’t the first thing that was considered when looking at making improvements. When the company was able to make further investments, it has always been in increasing capacity. Managing the production schedule has been reliably managed from inside a workbook, manually manipulating spreadsheets on a day-to-day, week-by-week and month-to-month basis.

“When Phil and I have had the ability to make investments in the past, we’ve wanted to invest in equipment since the management of ‘work in progress’ we can do ourselves, it doesn’t optimise it, but we can get the job done,” Garrett stated. New ownership, with greater investment potential, means the company is now ready and able to modernise in this area too.

Filaments for sinter-based metal Additive Manufacturing

To some, there is an obvious link between MIM and metal Additive Manufacturing, because of the more commonly associated reliance of the latter on metal powders. If we consider polymer AM for a moment, it was through the link to injection moulded plastics that the process first came into popular industrial use. It was quickly established that it was easier and cheaper to make additively manufactured prototypes before having to commit to expensive mould tooling. CMG simply made that connection themselves for MIM. “Our main reason for pursuing Additive Manufacturing was because we saw an opportunity to offer to customers the chance to see what their parts would be like without having to make the upfront investment in the tooling. We felt if they had the opportunity to see and feel their parts then that would encourage them to progress with the MIM process,” Garrett commented.

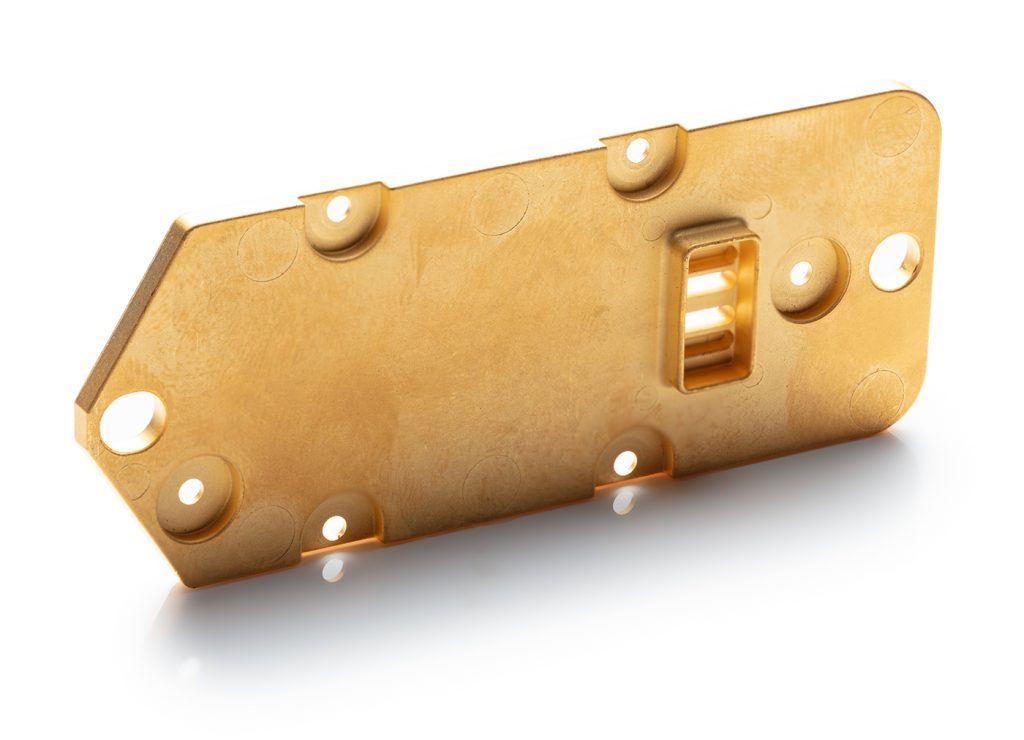

After having assessed that Binder Jetting was still underdeveloped and too expensive, the company opted for filament-based Material Extrusion (MEX,FFF) using metal-containing filaments that were available on the market. This quickly proved to be a good decision for the business, but being the type of company that can identify opportunities and react to them in an agile way, it was a logical step for CMG to produce its own filaments. This meant that it could start to offer more alloy types than what was commercially available, and it accomplished this without having to bring in any additional equipment.

CMG relies upon its existing systems for developing and mixing its MIM feedstock, whilst sub-contracting the actual extrusion and spooling. However, CMG didn’t set out to be a materials supplier to the maker community. Over a period of time that it has gone from catering to the needs of its own business to gradually realising that there was an opportunity to market the filament to other users of these systems.

It certainly seems there’s plenty of room for sales growth with these materials, and CMG claims that its particular type of filament is highly-suited to both small-scale prototyping and industrial use, with an ever-increasing range of alloys becoming available. These include typical stainless steels 316L and 17-4 PH, low-alloy steel, H13 tool steel, copper, and Ni-625.

During the visit, I talked with Sam Wilberforce, someone else with an infectious enthusiasm for metal Additive Manufacturing, and he explained the company’s plans to also develop filaments for both titanium and tungsten. It remains to be seen if these become successful but, judging by the way that the AM market is still growing and developing, it would not come as a great surprise to hear about it in the near future. Being part of the Indo-MIM family should give CMG the resources required to accelerate this, if needed, and certainly access to markets further afield.

Something else that works in the company’s favour is that the debinding solution used for its filament is acetone. Since the filaments are suitable for use in a range of entry-level FFF AM machines, this makes the process very affordable for anyone wishing to explore AM before making bigger investments. “Because of our expertise in selecting and blending MIM feedstocks, we have produced a filament that results in parts with an excellent surface finish compared to other metallic filaments,” explained Wilberforce excitedly. He then went on to show me some of the customers’ finished parts that enabled CMG to gain customers in the medical sector, as well as the fashion industry and other niche applications.

A provider of toll debinding and sintering services

Not resting on its laurels, CMG has also quietly been developing other services and positioning itself for further growth as a service provider of toll debinding and sintering services for both MIM and AM parts. Already working to support BASF with the debinding of customers’ parts made from its ultrafuse filament range, as well as 3DGBIRE from the northwest of England, with toll debinding and sintering, CMG also started advertising this service in the past few years for any customers that don’t have the capability to do this on their own.

It’s a compelling offer and works hand-in-hand with the company’s own Additive Manufacturing capability so that, for any company that wants either small volumes of MIM or additively manufactured parts, CMG can offer the whole process up to the stage prior to finish machining; this is still currently outsourced. CMG has a modest tool and machine shop, used mainly for maintenance of the mould tooling – all of which is also currently outsourced – and other systems.

CMG also hopes for more widespread adoption of metal AM into the consumer-based market, for which it feels ideally positioned due to its service offering. Many home-based users of polymer FFF machines can now also make metal parts using the metal filaments that CMG has developed, and then have CMG finish the process for them as well. It’s perhaps the first time that this author has been tempted into this area of the sector. It represents a very affordable way for individuals or very small companies to start making their own parts.

Concluding thoughts

It is clear that CMG Technologies’ primary focus remains on the MIM process and there’s still a lot to be explored between the new owners, Indo-MIM, and CMG’s directors, Garrett and Marsh. AM, however, presents a significant new opportunity and there is a continued ambition to embrace innovation. With the backing of Indo-MIM, bigger opportunities to expand and explore new areas are now within reach.

Author

Dr Martin McMahon

Technical Consultant, PIM International magazine, and founder of M A M Solutions.

[email protected]

Contact

Rachel Garrett

Managing Director

CMG Technologies – 3D Metal Moulding

[email protected]

www.cmgtechnologies.co.uk