Global Markets for Metal Injection Molding: Data and insight from World PM2022 and beyond

How has the global Metal Injection Molding industry weathered the most turbulent years in recent history, and what has the impact been on MIM’s key markets worldwide? In this overview, PIM International’s Nick Williams reports on market data presented at World PM2022, the first Powder Metallurgy World Congress since the COVID pandemic, held in Lyon, France from October 9-13. This is supplemented by other available data sources and insight from conversations with industry leaders at the event. [First published in PIM International Vol. 16 No. 4, December 2022 | 15 minute read | View on Issuu | Download PDF]

The PM World Congress series has, for many years, presented a rare opportunity to speak face to face with a significant number of Metal Injection Moulding industry suppliers and part producers from around the world, to get a feel for the direction the industry is going in, and to understand the opportunities that companies are seeing as well as the challenges that they are facing. Combined with some usually hard to come by data from the congress’s ‘State of the PM Industry’ presentations from different world regions, combined with insight from Special Interest Seminars, a picture can emerge of the health and prosperity of the MIM industry.

The 2022 World PM Congress & Exhibition, organised by the European Powder Metallurgy Association (EPMA), was the latest event in this series, bringing over 1,000 visitors from the Powder Metallurgy industry to Lyon. Unfortunately, COVID restrictions in China prevented attendance from the world’s largest MIM part producing nation, and a more general reluctance to travel from other parts of Asia and North America – be it for health concerns or reduced travel budgets – resulted in a gathering that felt significantly more regional than past world congresses. Nevertheless, despite the majority of attendees coming from within Europe, the organisers reported that fifty-six countries were represented.

Ahead of arriving at the congress, and in light of a global economy rocked by COVID and, later, Russia’s invasion of Ukraine, I had limited expectations about how upbeat conversations with MIM producers would be, and what industry statistics would reveal. Once on site, however, it became clear that the MIM industry had not only bounced back from the hit to production that COVID triggered in 2020, but that it was thriving.

The status of MIM in Europe

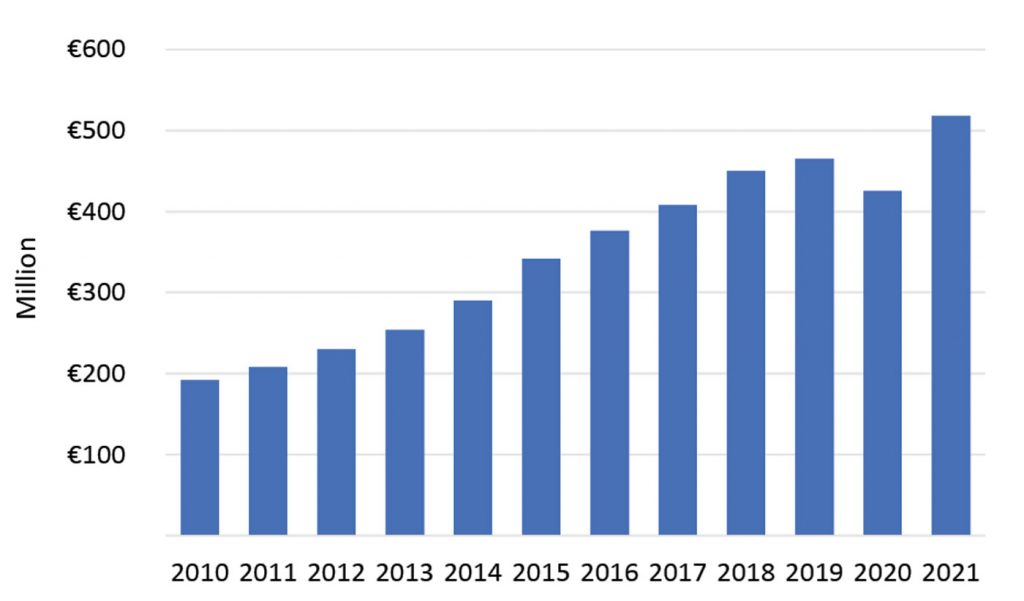

Fig. 2 shows that MIM sales in Europe bounced back in 2021 from a COVID-related dip, showing a sales increase of 22% from 2020 and breaking the €500 million mark for the first time in the technology’s history. Expectation is that 2022 will show continued growth on 2021.

There are multiple reasons for such a positive current position. One European industry professional explained that it had been a “remarkable year” for MIM in the region, with new entrants in the market, but more importantly, with MIM “enjoying increased recognition in the automotive sector as a new generation of vehicles are designed and parts are becoming ever more complex.”

This is especially the case for electric vehicles, where entirely new vehicle platforms offer the chance to design for MIM from the start, reducing part weight, increasing functionality and complexity, and potentially combining what would have been multiple components into one. Other sources also confirmed that Tier 1 and Tier 2 suppliers are taking a serious look at MIM for numerous new applications, again primarily for next-generation automotive applications.

Of course, the hard reality of the past two years is that, whilst potential new applications exist, those MIM producers most closely tied to the automotive industry faced the biggest challenges as COVID and the supply chain crisis impacted automotive production. But the above reports bode well for the future of a sector that is crucial for the European MIM industry.

What could be interpreted as an increasing interest in MIM from the automotive industry coincides with increased confidence of MIM producers in their own process capabilities. One European MIM producer explained that, in recent years, it has been able to successfully produce complex parts in high volumes that not so long ago would have been regarded as too challenging – thanks to advances in the quality and capability of MIM feedstocks, processing technology and simulation software.

Another factor behind the upbeat mood of European MIM producers is reshoring. One MIM producer stated that “reshoring is having a visible and very positive effect on MIM production in Europe, with parts coming back to Europe from China and India.” There were also suggestions that MIM’s end-users went through a restocking programme in 2021 – perhaps even overstocking – as they tried to anticipate future consumer demand.

Within Europe, a key market for parts made by MIM and Ceramic Injection Moulding is luxury products – including components for high-end watches and leather goods. “Right now, people are buying luxe, and demand for PIM parts is extraordinary,” stated one producer.

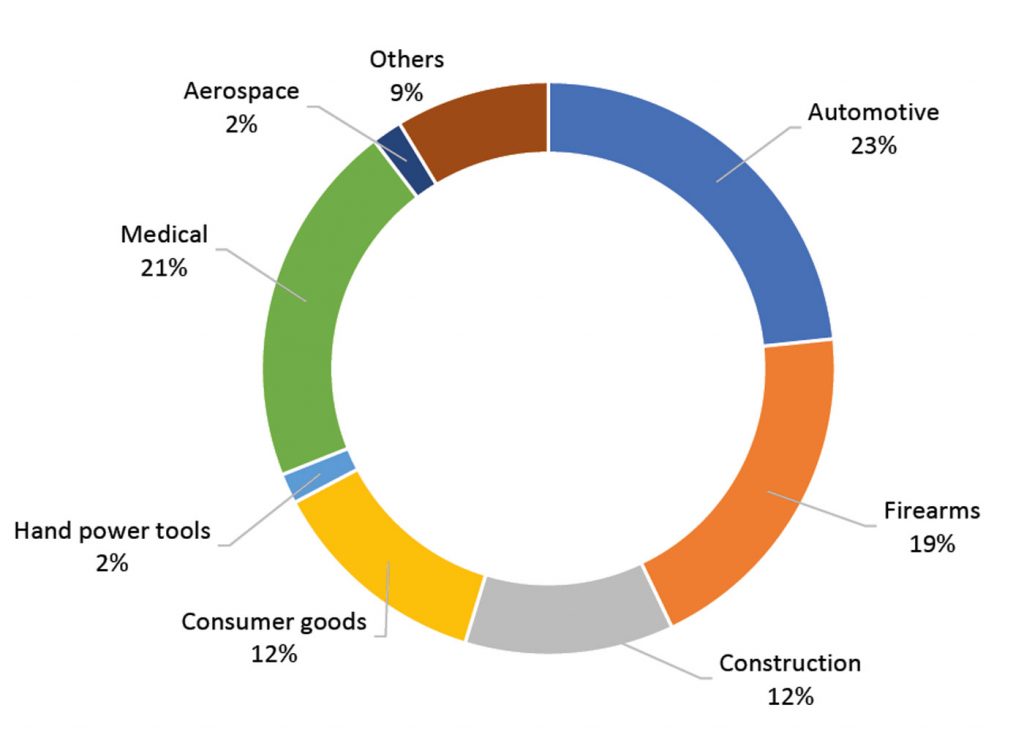

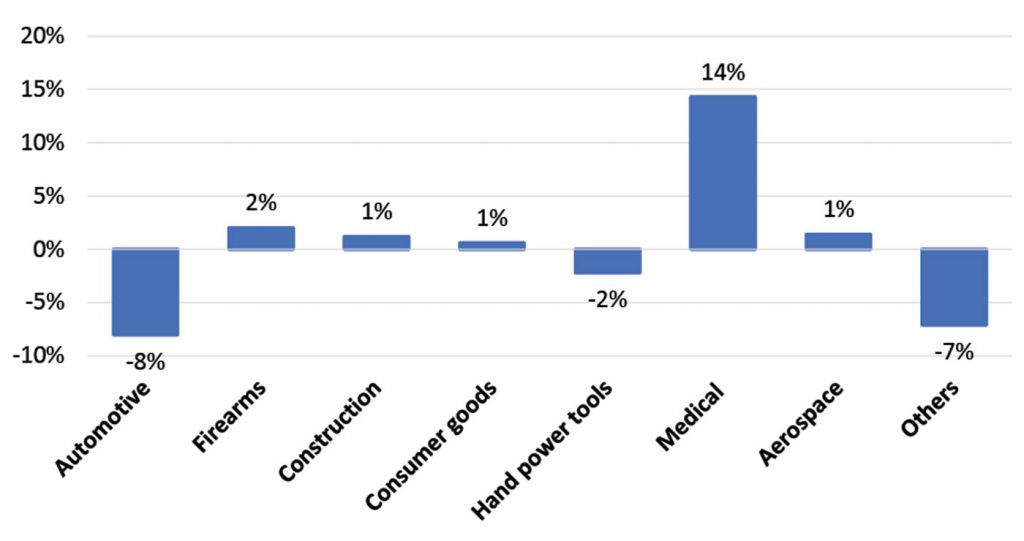

Fig. 3 shows a breakdown of the European MIM market by sector based on sales. Automotive, firearms and medical remain the largest markets – however, as Fig. 4 clearly shows, 2021 recorded a drop in the value of the automotive sector, whilst the value of the medical sector increased. Whether this is a sign of more permanent changes in the market for MIM parts in Europe remains to be seen, as supply chain challenges such as the semiconductor crisis were largely responsible for reducing automotive volumes in the period. The market for internal combustion engines (ICEs) continues to decline, however, with diesel’s share of the market falling from 27.9% to 19.6% in 2021, and petrol from 47.6% to 40%. Currently, MIM parts are used for both powertrain applications and other automotive applications such as suspension systems, sensors, thermal management and interior fittings, so the impact of the switch to vehicle electrification remains to be seen.

Putting European MIM into context in his World PM2022 plenary presentation, Ralf Carlström, EPMA president, stated that the value of MIM parts accounted for 4% of PM-related parts production in Europe in 2021 by sales. The most valuable PM product segment was hard materials, accounting for 30% of the total market value of PM parts due to the high price of raw materials, followed by PM structural parts/bearings at 25%, diamond tools at 16%, sintered magnets (12%), PM semi parts (8%), HIP parts (3%) and AM parts (2%). However, the growth in value of MIM part sales in 2021, at 22% over 2020, outstripped PM structural parts production (11.4%), HIP (20%), and AM (15%) in 2021.

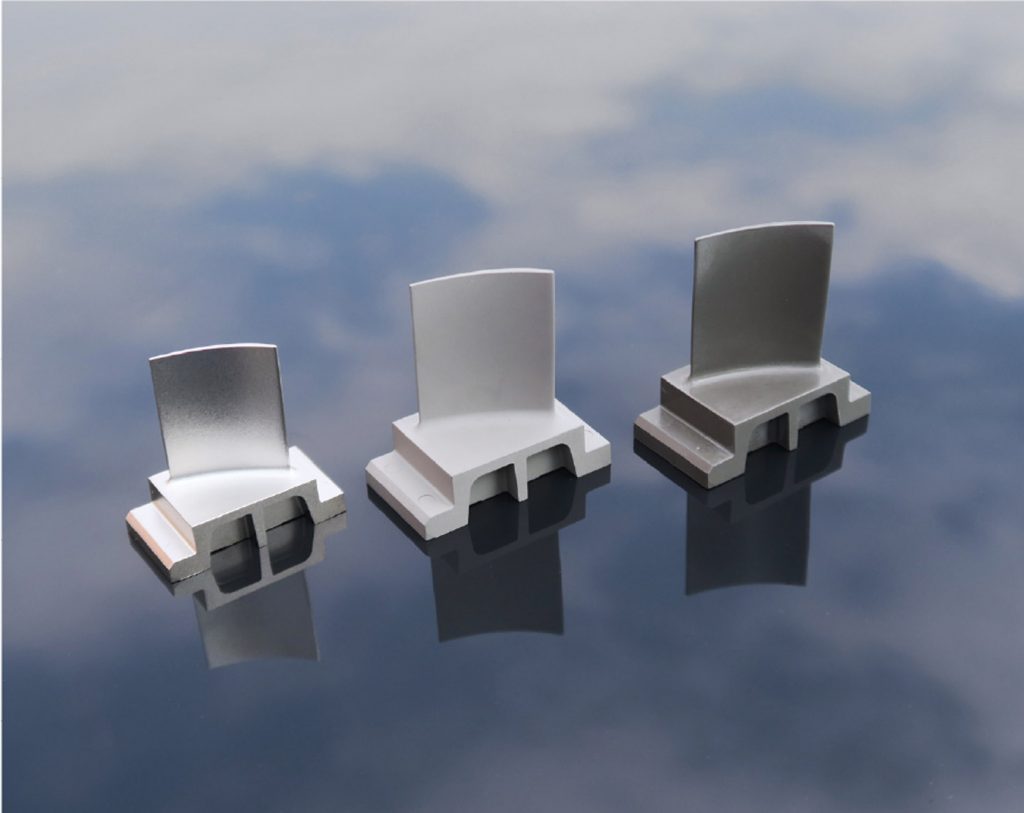

What is not fully apparent in these charts is the growing value of the aerospace industry for MIM in Europe. As reported in PIM International, Vol. 13 No. 3, September 2019, Schunk Sintermetalltechnik GmbH is one example of a European MIM producer that has found success in manufacturing a new generation of high-performance MIM components that are now flying in Rolls-Royce aero engines, with an example being IN713LC superalloy stator vanes (Fig. 5). Alliance-MIM, a French MIM producer, is also reporting success in this area, with rotating MIM aero engine parts accounting for 25% of its MIM sales.

MIM in Asia

A picture of MIM in Asia was presented by Chiu-Lung Chu, president of the Asian Powder Metallurgy Association (APMA). The APMA is made up of the Japan Powder Metallurgy Association (JPMA), Japan Society of Powder and Powder Metallurgy (JSPM), Korean Powder Metallurgy Association (KPMA), Korean Powder Metallurgy & Materials Institute (KPMI), Taiwan Powder Metallurgy Association (TPMA), China Powder Metallurgy Alliance (CPMA), China Powder Metallurgy Society, Powder Metallurgy Association of India (PMAI), and Thailand Powder Metallurgy Association (ThaiPMA). The statistics presented in Chu’s overview were provided, separately, by these associations.

China and Taiwan

Around half of global MIM production, about $1.5 billion, comes from China and Taiwan, with the latter accounting for around $300 million of sales.

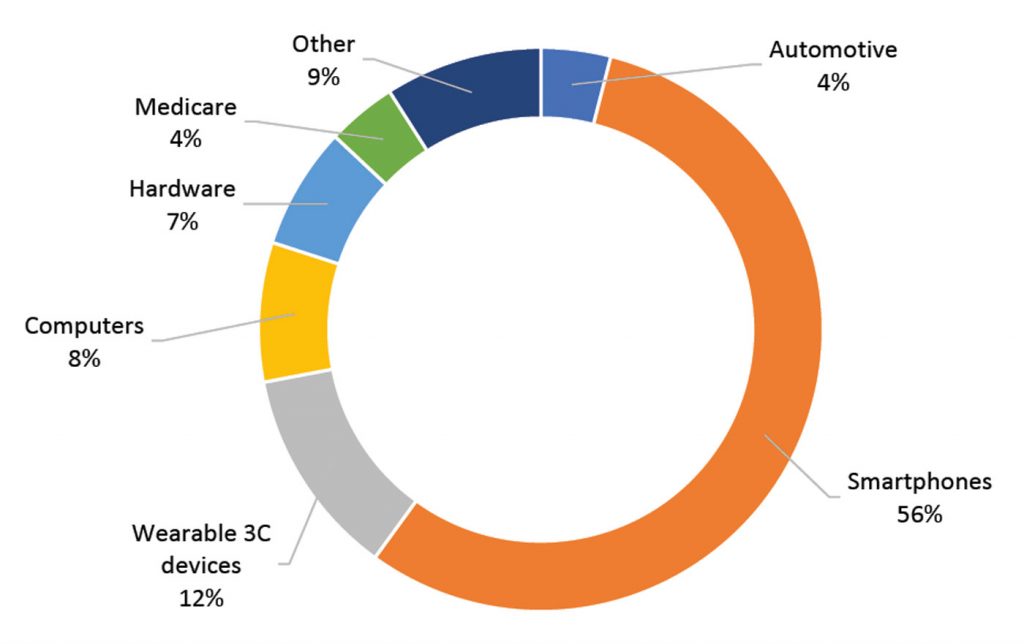

As seen in Fig. 6, in 2021 the vast majority of China’s MIM parts went to the electronics sector, with the remainder delivered to automotive (4%), medical (4%), hardware (7%), and other industries (9%). Smartphone parts made up the majority of applications at 56%, followed by wearable electronics such as smartwatches at 12%, other applications at 9%, and computer components at 8%. In all, more than 75% of all MIM applications were for the consumer electronics industry.

The future for MIM in the crucial smartphone sector is somewhat unclear. Apple recently announced that it would be ending its use of the Lightning connector (Fig. 7) in favour of USB-C, a move that will result in the loss of an extremely high volume of MIM parts. However, the growing use of MIM components in elsewhere in smartphones, in tablets, laptops, smartwatches, headphones and headphone cases should offset these losses. Other MIM components that may also be at risk as smartphone designs evolve include volume buttons and SIM card trays. Opportunities for MIM hinges in any future folding devices could be significant. This would, however, depend on the continued growth in foldable device sales.

It was reported by Chu that the majority of MIM parts produced in Taiwan were also consumed by the consumer electronics sector (60%), while 17% went to transportation, 16% to industrial and 7% to other sectors.

Japan

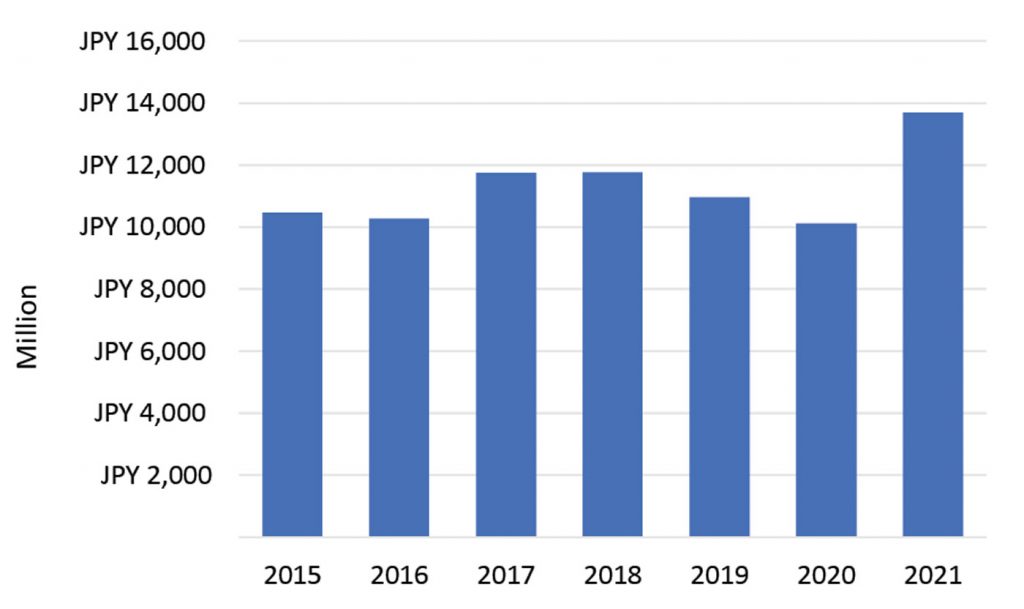

The most comprehensive information on MIM in Japan was presented by Kenji Doi, Osaka Yakin Kogyo Co., Ltd, Japan, in a World PM 2022 Special Interest Seminar. His reporting was largely based on the JPMA’s 2021 Report for MIM Market. Doi stated that annual total MIM sales in Japan in 2021 were JPY 13.69 billion (approx $100 million) and he stated that sales volume had increased over the previous year (Fig. 8). The JPMA collects what are believed to be the most detailed MIM industry statistics available, generated each year through a questionnaire sent to nineteen companies, including members and non-members. 2021’s figures are from data provided by all nineteen companies.

The value of Japan’s MIM sales in 2021 represents a 35.5% increase from the previous year. This, it was stated, was the result of the recovery demands in all markets following COVID-19, but especially in the strongly increasing demand for components for semiconductor manufacturing equipment. This is the first time since 2008 that MIM sales have passed the JPY 13 billion mark. “We have forecast that the strong demand of semiconductor manufacturing equipment parts will continue until the end of 2022, and the sales amount equal to or more than that in 2021 can be expected,” noted the JPMA report authors.

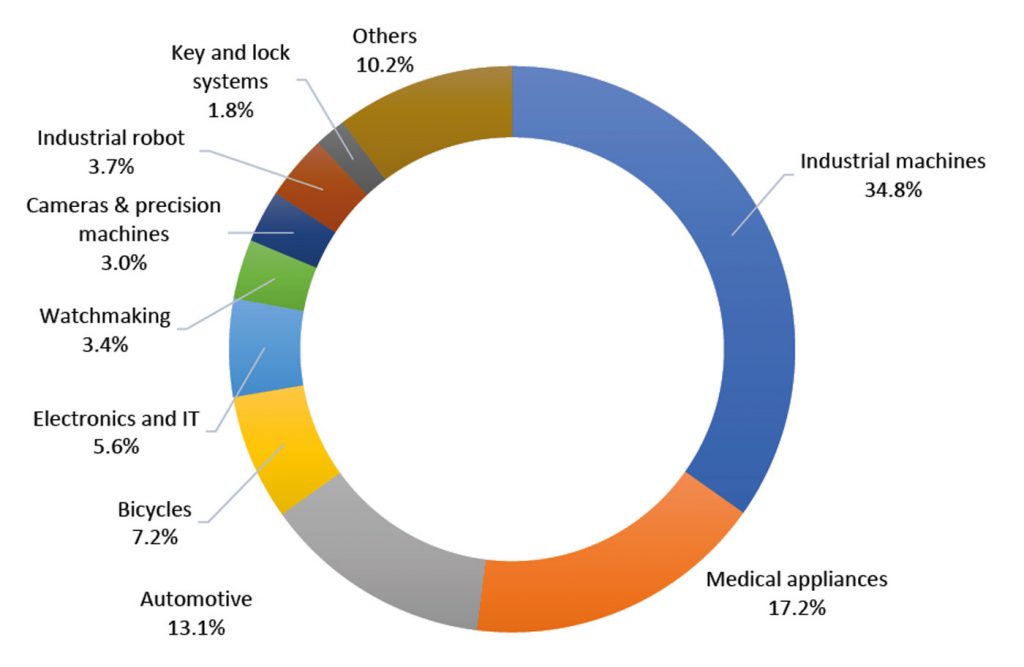

In terms of market breakdown, industrial machine parts accounted for 34.8% of sales (previous year: 29.3%), medical appliance parts accounted for 17.2% of sales (previous year: 18.2%) and automotive parts accounted for 13.1% of sales (previous year: 14.6%). Highlighted growth areas included industrial robot parts, with high demand expected as a result of the drive to automate global production lines. The JPMA’s MIM report also stated that a reshoring of MIM production was being experienced in Japan, with COVID-19 and geopolitical issues driving a return to domestic production. Fig. 9 shows a detailed breakdown of the MIM market in Japan in 2021.

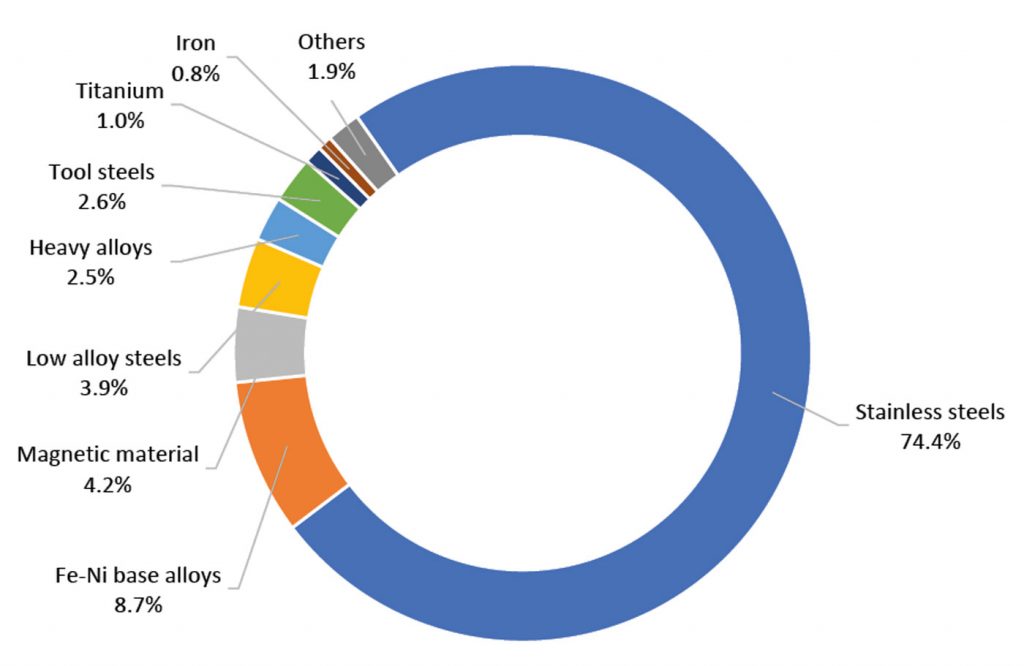

In terms of material usage, stainless steels accounted for 74.4% of production (previous year: 73.2%). Stainless steels, Fe-Ni materials and magnetic materials accounted for over 85% of production. The value of stainless steel MIM parts sales in 2021 was stated as JPY 10,193 million, a 36.4% increase from the previous year. Fig. 10 shows a detailed breakdown of MIM materials usage in Japan in 2021.

Whilst titanium MIM appears to be slow to develop in Japan, it was reported that developments relating to heat-resistant steels and spring steels are progressing. Concluding, the report stated that areas of highest concern were metal powder price increases and lead times.

India, Korea and Thailand

Application data was presented for these countries during the ‘MIM in Asia’ plenary presentation. India saw a fairly even split across the various MIM application fields, with electronics holding a market share of 30% followed by transportation and other industries at 25% each, and industrial at 20%. It is estimated that in 2021 India generated MIM sales of around $300 million, with Indo-MIM accounting for a significant proportion of this.

For Korea, the majority of MIM parts went to the automotive/transportation sector (80%), and the remainder to industrial (15%) and electrical (5%). In Thailand, the majority of MIM use was in industrial applications (60%), 20% in electronics, and 20% in other fields.

The MIM industry in North America

Metal Powder Industries Federation (MPIF) President Rodney Brennen gave delegates a detailed overview of the state of the North American Powder Metallurgy industry during the World PM2022 plenary session. The North American Powder Metallurgy industry, he reported, had not been immune from the challenges facing the global supply‐chain, and continues to feel the negative effects of the COVID‐19 pandemic.

Speaking about the broad PM industry, including MIM, he stated that new production output levels are being achieved thanks to changes and innovations made because of the pandemic, and many companies report reductions in energy consumption, furnace atmosphere gases, scrap, and waste that is sent to landfills as a direct result of operating more efficiently. He also stated that some companies have also replaced older equipment with the latest computer controlled Industry 4.0 technology. This ‘Internet of Things’ approach allows equipment to ‘talk’ to each other and learn the best parameters for the process, and automation within the industry continues to grow as a solution to the overall shortage of skilled workers. From pick‐and‐place robots to 100% vision system inspections, automation is expected to continue to increase.

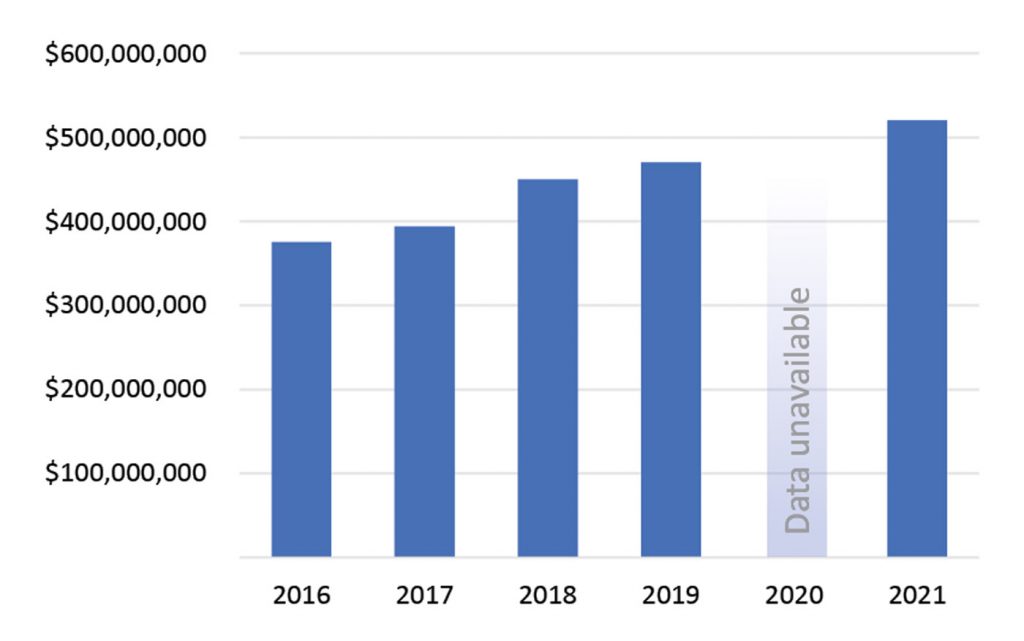

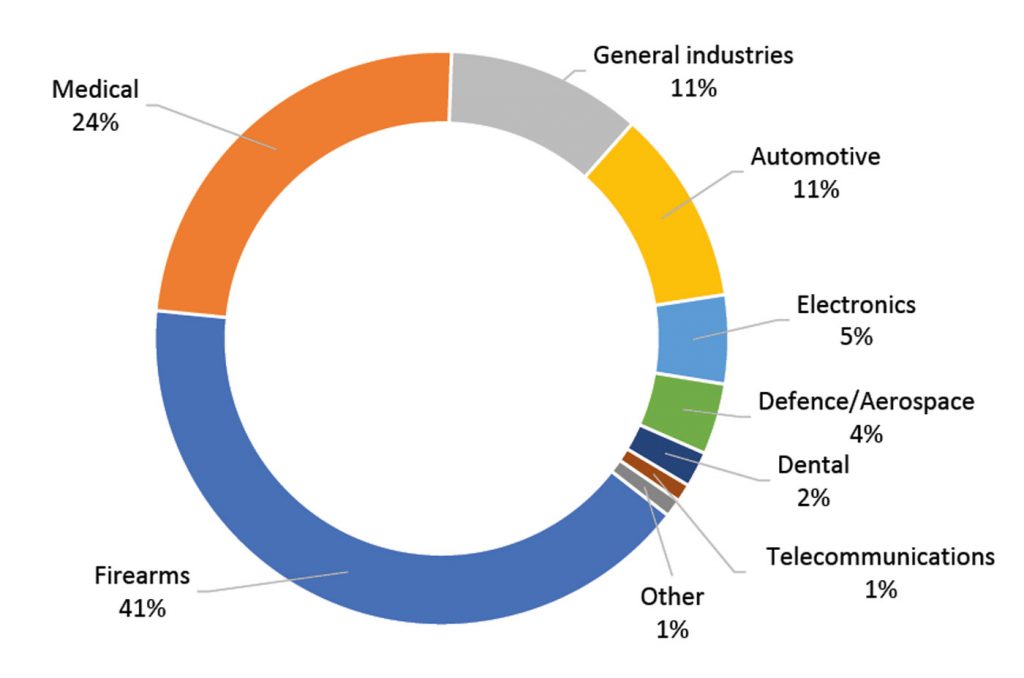

By value, the MPIF has reported that US MIM sales reached $520 million in 2021 (Fig. 11). In terms of markets, the firearms sector continues to dominate US MIM parts production, at 41%, by weight, of parts shipped. This is followed by medical devices at 24% by weight. Fig. 12 shows a full breakdown of US markets for MIM, based on an MPIF PM Industry Pulse Survey undertaken in August 2021. It should be noted that these US figures differ from those for Europe, China and Japan, where the market breakdowns are by sales value rather than weight.

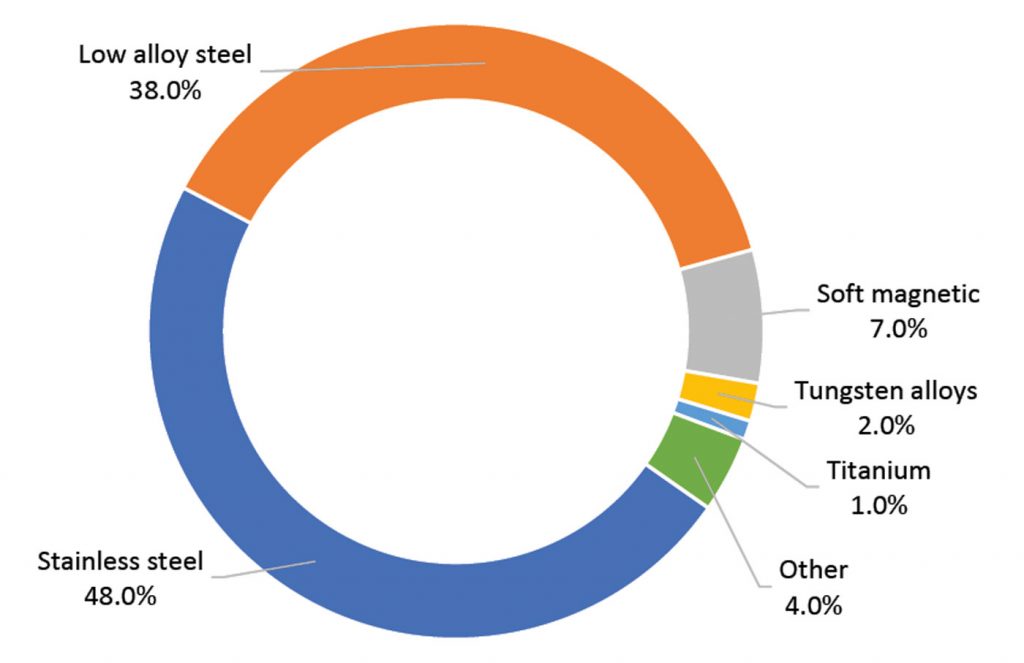

Total 2021 North American metal powder shipments to the MIM and AM industries increased by an estimated 5–10% to between 3,934,767 and 4,202,178 kg. Of this amount, an estimated 360,000 kg is dedicated to AM. MIM and AM powder producers were reported to be seeing strong demands for materials. Generally, the materials of choice are stainless and low-alloy steels, but there is considerable developmental work being performed on aluminium, titanium, and an array of other metal powders and alloys. Fig. 13 gives a breakdown of North American MIM materials usage.

In his presentation on the North American MIM market in the Special Interest Seminar on Global MIM markets at World PM2022, Stefan Joens, Elnik Systems, stated that growth in the North American MIM industry was mirrored by growth in production equipment sales. He also stated that new entrants were setting up MIM facilities in the US, and that many producers were now offering both MIM and Additive Manufacturing – with Binder Jetting being the most adopted AM process by MIM producers thanks to its potential for series production.

MIM materials insight

During his presentation on the European MIM industry in the World PM2022 Special Interest Seminar on Global MIM markets, comments by Paul Davies, Sandvik, UK, a leading supplier of gas atomised MIM-grade powders, mirrored the market data presented in terms of a global COVID-related dip in MIM production. He stated, however, that MIM powder shipments to Asia from Sandvik had reduced the most in 2020 and 2021 – during the COVID period – compared to the other regions. He added that, whilst Europe had benefitted with an increased share of MIM powder shipments, North America also rebounded strongly, with MIM powder shipments now levelling off to pre-pandemic levels.

Davies also explained that purchasing trends for metal powders have also changed since the pandemic, with customers looking to secure longer term contracts for stability of metal powder supply. MIM powder sales, he stated, continue to be dominated by stainless steels, in particular 316L and 17-4 PH.

Powder prices continue to be a concern for the MIM industry, with the gains brought by a more competitive marketplace offset by higher raw material costs, higher energy prices and the high costs of the gases used during atomisation.

In terms of MIM feedstock developments, BASF SE, Ludwigshafen, Germany, promoted its new Catamold® THOR feedstock at World PM2022; a maraging ultra-high strength steel suited for parts that require the combination of strength and ductility/toughness. Target applications include MIM hinges and other high-performance structural applications. MIM hinges are seeing widespread adoption in the consumer electronics industry, in particular for laptops and folding smartphones, where the unique combination of component complexity, high production volumes and demanding tolerances play into MIM technology’s strengths.

There were also indications at World PM2022 that new entrants to the MIM feedstock market are on the horizon, including from companies based in Europe and Asia.

Outlook

This review covers a large proportion of the global MIM industry; however, sales figures for many MIM producing countries in Asia, South America and elsewhere are not included. The data for China, Taiwan, Japan, India, Europe and North America alone, though, suggest an industry with annual sales in excess of $3 billion.

The global MIM industry is in a strong position for continued growth. Whilst there is inevitably uncertainty due in large part as a result of war in Ukraine companies around the world are investing in production capacity. The most recent EPMA survey of MIM producers, the results of which are confidential but were presented during the EuroMIM meeting at World PM2022, provided evidence of investment in the European MIM industry to increase sintering capacity and for new injection moulding equipment.

Future growth is expected to come from both new applications as well as an expansion of existing markets. Additionally, MIM has never been in the headlines as much as it has with the rise of metal Additive Manufacturing, especially Binder Jetting. Has this heightened awareness driven business to the doors of MIM producers? Some believe so. Right now, MIM is far more capable of delivering parts to the necessary standards and volumes than any upcoming metal AM process. The reality is, however, that MIM remains a technology that is unknown to far too many designers and engineers and a concerted effort by the industry is required to improve this situation.

But what is certain is that the boundaries between MIM and sinter-based AM continue to blur. A significant percentage of MIM companies are seeing AM’s potential and diversifying into sinter-based metal AM. Here, Binder Jetting leads as previously suggested, but filament- or pellet-based Material Extrusion (MEX) and a number of viable process variants are also being commercialised. The motivation is clear – these technologies allow MIM firms to leverage installed sintering capacity and expertise, and take on parts that would previously have been turned away.

Author

Nick Williams

Managing Director and Editor

PIM International

[email protected]

Primary sources of data

Asian Powder Metallurgy Association (APMA)

www.apma.asia

European Powder Metallurgy Association (EPMA)

www.epma.com

Japan Powder Metallurgy Association (JPMA)

www.jpma.gr.jp

Metal Powder Industries Federation (MPIF) and its Metal Injection Molding Association (MIMA)

www.mpif.org | www.mimaweb.org