Worldwide smartphone shipments see 7% decline in Q3 2018

December 1, 2018

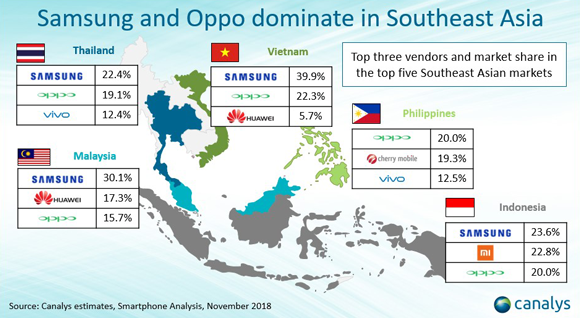

In Southeast Asia, Samsung and Oppo have the highest market share (Courtesy Canalys)

Worldwide smartphone shipments fell by 7% in the third quarter of 2018, according to a report by global technology market analyst firm Canalys. This was said to be the worst third quarter performance the industry has seen since 2015.

In China, the smartphone market shipped 100.6 million units, a year-on-year decline of 15.2% and sequential decline of 2.9%. India overtook the US as the second largest market, though both countries were said to have been hit by weaker seasonal performance compared with last year. Seven of the top 10 markets recorded year-on-year declines reported to be caused by lengthening smartphone replacement cycles, worsening international trading conditions and competition from major Chinese vendors.

Fourteen of the top twenty smartphone brands in China were said to have declined in Q3 2018, putting pressure on vendors amid increasing component and labour costs. Chinese vendors are said to be highly focused on overseas expansion in South Asia, Africa, and Central and Eastern Europe, to hedge against domestic business challenges, but it was stated that the current international trade environment and geopolitical issues will have a negative impact on business.

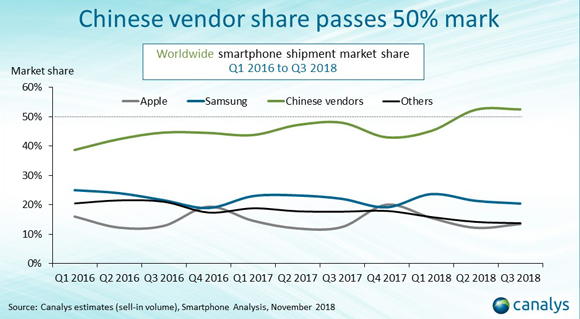

All Chinese smartphone vendors combined now account for 52% of the worldwide smartphone market (Courtesy Canalys)